Folster

ASFN Icon

- Joined

- Jun 23, 2005

- Posts

- 17,111

- Reaction score

- 7,878

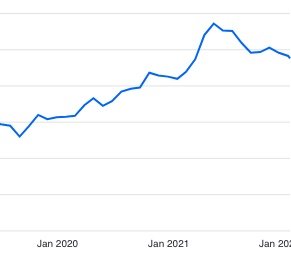

The trick is that unless you are renting or shopping for a house, you are somewhat immune to that component of inflation.I was going to say the same thing about owner equivalent. I haven't found if it's accurate or not but I heard that if it was calculated the old way we'd be at about 14% for last year. That's nuts. I hate it when government agencies play with the parameters to make the outcome number look one way or another. It's like claiming unemployment went down when the number of jobs stayed the same but the participation rate dropped.